These returns cover a period from January 1, 1988 through October 7, 2024. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return.

How stock buyback impact shareholders

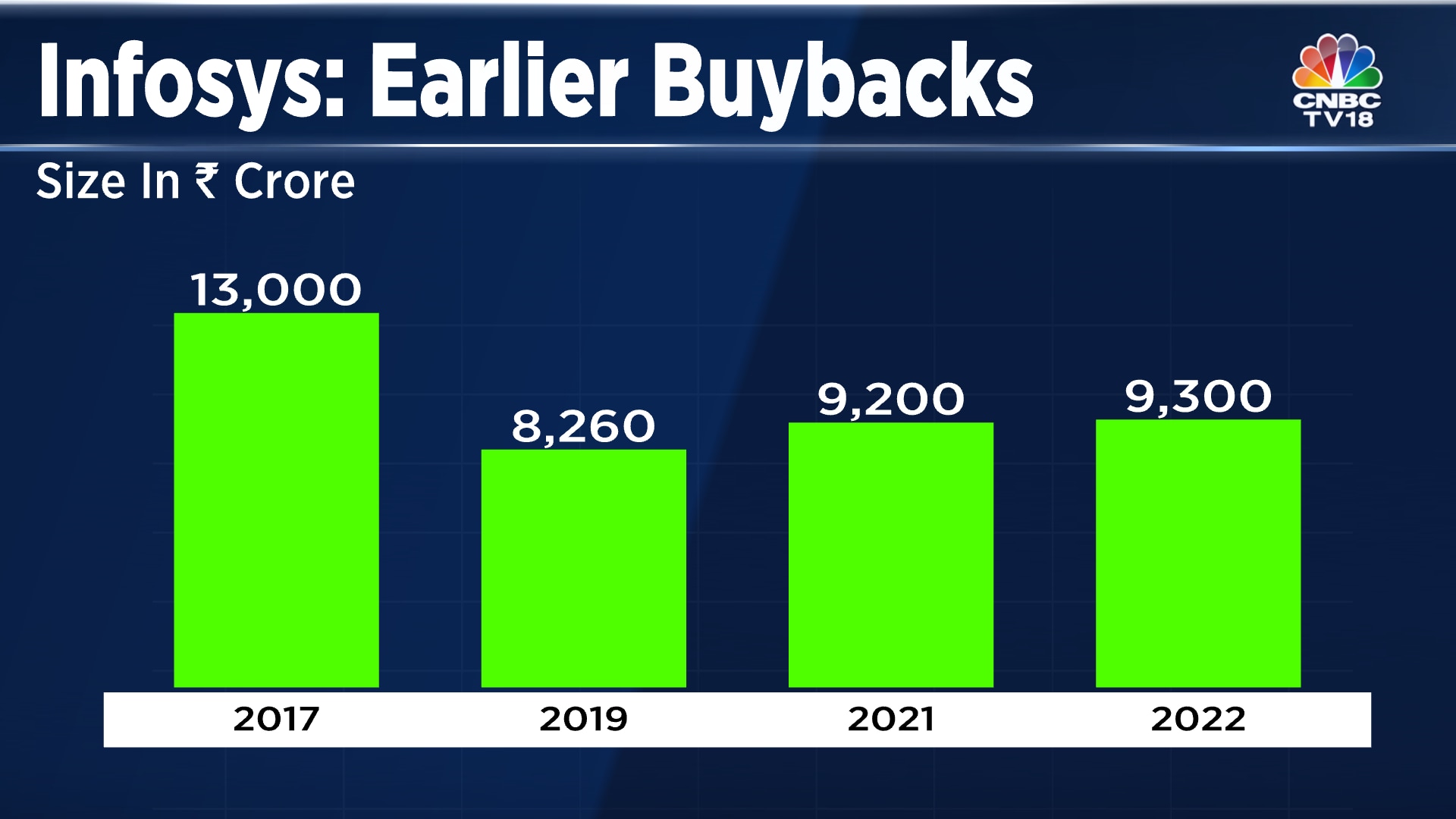

A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares outstanding. In effect, buybacks “re-slice the pie” of profits into fewer slices, giving more to remaining investors. There are many examples of share repurchases or buybacks in the marketplace.

Ask Any Financial Question

In addition, companies can choose to use some (or even all) of their profits to reinvest into the business in an effort to fuel growth. To be perfectly clear, buybacks and dividends aren’t an either-or scenario. Companies can choose to do some combination of both buybacks and dividends, and many do exactly that.

Subscribe to Kiplinger’s Personal Finance

- A stock buyback is one of the major ways a company can use its cash, including investing in its operations, paying off debt, buying another company and paying out the money as a dividend to investors.

- For example, many companies are flush with cash in strong economic environments, but their valuations are also high.

- That could be a good investment, because the CEO is focused on putting capital – shareholders’ money – into attractive investments.

- Let’s say that Company X has 10 million outstanding shares and earns $20 million in profit this year.

- Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

It shows that the owners expect the company’s value to rise in the future. Otherwise, there would be no reason for the company to buy its own stock. Finally, the company can buy back its own stock on the open market to artificially increase demand.

Part 3: Confidence Going Into Retirement

Zacks may license the Zacks Mutual Fund rating provided herein to third parties, including but not limited to the issuer. Buying back stock can help a business look more attractive to investors. Investors may see that a buyback means a company is financially healthy, no longer needs excess equity funding, and is confident to reinvest in itself. By reducing the number of outstanding shares, a company’s earnings per share (EPS) ratio is increased because its annual earnings are now divided by a lower number of outstanding shares.

Why would a company buy back its own stock?

However, if it repurchases 10,000 of those shares, reducing its total outstanding shares to 90,000, its EPS increases to $111.11 without any actual increase in earnings. A 1% excise tax in effect for 2023 and high interest rates dampened the numbers that year, though 2024 has seen increases in stock buybacks again. Novo Nordisk has announced the continuation of its ambitious 2024 share repurchase program, now initiating an additional buyback of up to DKK 3.14 billion. This move aims to reduce the company’s share capital and fulfill obligations from share-based incentive programs. The repurchase, which involves up to 400 million B shares, is set to occur between November 11, 2024, and February 3, 2025. Each of these reasons demonstrates how stock buybacks, when executed strategically, can serve multiple corporate objectives, from enhancing shareholder value to optimizing capital structure and improving market perception.

A similar effect can be seen for EPS, which increases from 20 cents ($2 million ÷ 10 million shares) to 22 cents ($2 million ÷ 9 million shares). In other words, companies want to do everything in their power to prevent from having to cut their dividends, so many tend to keep power of attorney dividends at a reasonably low percentage of total profits. As a simplified example, if a company only pays out 30% of its profits in the form of dividends, its earnings can plunge by as much as 70% and there will still be enough money coming in to sustain the dividend.

Don’t miss out—download 12 Stocks To Buy Now and claim your front-row seat to the coming boom. We realize that everyone was once a new trader and needs help along the way on their trading journey and that’s what we’re here for. Also, we provide you with free options courses that teach you how to implement our trades as well.

The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

Leave a Reply