This KPI analyzes and compares similar equipment, production lines and manufacturing plants. It’s calculated by dividing the total number of good units produced by the specific time frame. A manufacturing KPI is a metric to understand the efficiency of the production process.

Ask a Financial Professional Any Question

This data encompasses a wide array of variables, from direct costs like raw materials and labor to indirect expenses such as overhead and maintenance. By dissecting this information, companies can pinpoint areas of inefficiency, identify opportunities for cost reduction, and optimize their resource allocation. Moreover, understanding the cost of production is essential for pricing strategies, ensuring that products are competitively priced while still generating a profit.

ProjectManager Helps With Production Reporting

But on the flip side, a software company might have different production costs. These could be things such as web hosting, third-party applications, and software licenses. Keep reading to find out everything about production costs and how they can affect your business. Production cost is also known as factory cost and cost of goods manufactured.

Why You Can Trust Finance Strategists

Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know. We need just a bit more info from you to direct your question to the right person. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

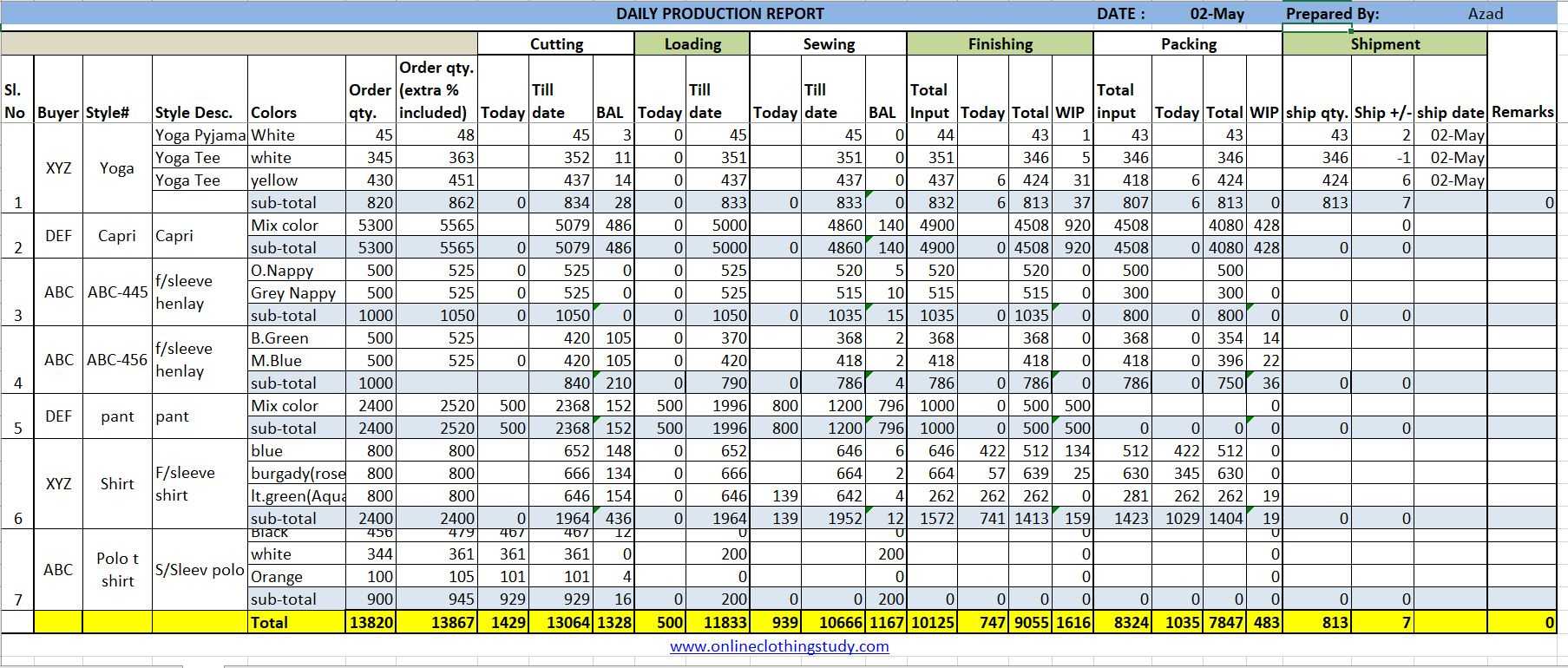

The company had 750 shells in process at the close of business on January 31. The beginning inventory of 750 plus the 3,250 pie shells worth of materials placed into production during the month gives us 4,000 total units to account for. A production report will also include the production capacity utilization rate, any issues in the production line and how efficiently products are manufactured in terms of time, quality and costs.

- A work-in-process inventory (wip) is an account that represents the cost of partially completed products.

- The accurate calculation of these costs not only reflects the efficiency of production processes but also impacts the pricing strategy, profitability, and competitive positioning of a company’s products.

- The balance of the manufacturing account discloses the total cost of goods manufactured, which is then transferred to the trading account.

- The production cost report for the month of May for the Assemblydepartment appears in Figure 4.9.

These include fixed costs, variable costs, total costs, average costs, and marginal costs. The main component of production cost is prime cost, also known as direct material and direct labour. Factory overheads, considered secondary to prime costs, are all indirect expenses related to factory management including cost of machine Depreciation. Following is a complete cost of production report that accounts for all the Balloon department’s units and costs.

An example to illustrate the importance of COGM analysis could be a scenario where a company notices a significant increase in COGM without a corresponding increase in production volume. This could indicate issues such as rising material costs, inefficiencies in labor, or increased overhead expenses. By identifying the root cause, the company can take corrective actions such as negotiating when to use a debit vs credit card better material prices, investing in employee training, or optimizing energy consumption. From a managerial perspective, the allocation of manufacturing overhead is about more than just numbers; it’s about understanding cost behavior and making informed decisions. Managers need to understand how overhead costs behave in relation to changes in production levels to manage costs effectively.

But for a production cost to get labeled as an expense, it must get incurred when producing the product or service. Production might include things like rent, direct labor costs, raw materials, and machinery. 24,000 units were received from the first department during May. 14,000 units were completed and transferred to the finished goods store room, and 10,000 units were still in process at the end of May. The units in work-in-process ending inventory were 50% complete with respect to materials and 25% complete with respect to labor and manufacturing overhead costs.

Leave a Reply